Compute return on investment

Finding the amount you would need to invest today in order to have a specified balance in the future. The final value will show the actual ending balance if you want to compute a total return instead.

Return On Investment Roi What Does Roi Mean

The project will earn a rate of return higher than its discount rate which is the rate used to compute net present value.

.jpg)

. In Johnnys portfolio the annual returns are. You can also sometimes estimate present value with The Rule of 72. The method may be applied either ex-post or ex-anteApplied ex-ante the IRR is an estimate of a future annual rate of return.

In finance return is a profit on an investment. He provides tax advice to various start-up enterprises and clarified tax concerns of individual taxpayers. Among other places its used in the theory of stock valuation.

The total investment amount for his portfolio is 750000. Miguel Dar is a CPA and an experienced tax consultant who specializes in tax audits. Our Property Investment Analysis PIA program is an essential decision tool for investors.

Whether there is an. It analyzes an investment project by comparing the internal rate of return to the minimum required rate of return of the company. The software will compute cash flow projections for up to 40 years and has facilities for changing more than 100 variables including property.

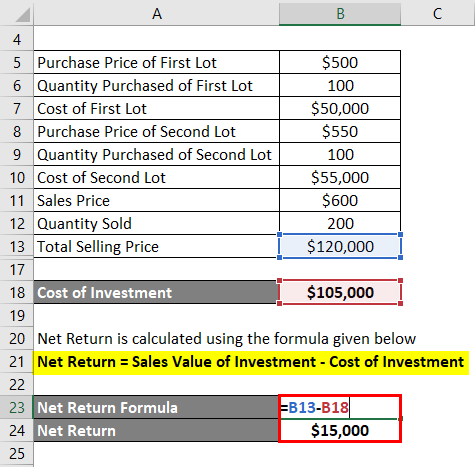

A retail clothing business submits an application for a loan from a community bank on February 1 2016. All lumpsum calculator mutual fund uses a specific method to compute the estimated return on investment. Lets look at the process below.

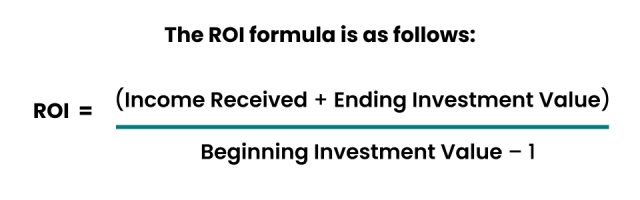

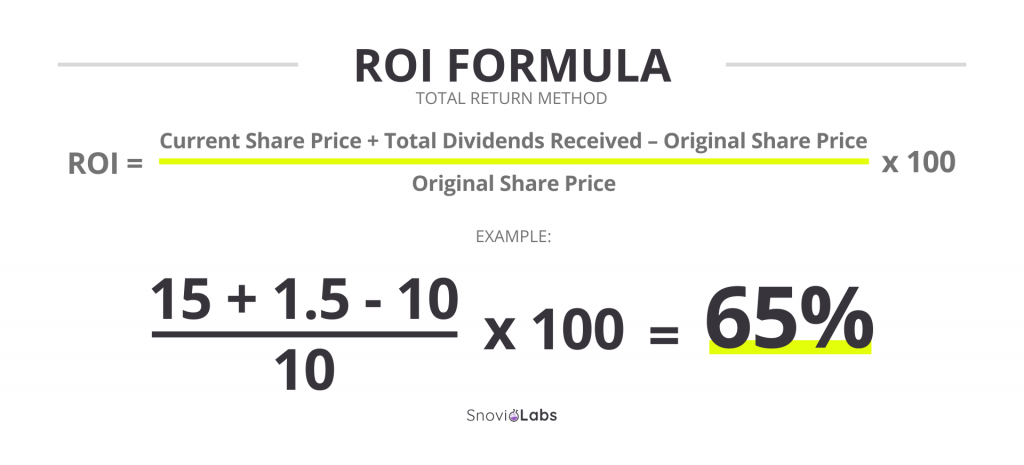

The formula is as follows. The total percentage gain or loss on your investment or net return on investment. IRR Dollar-Weighted Return.

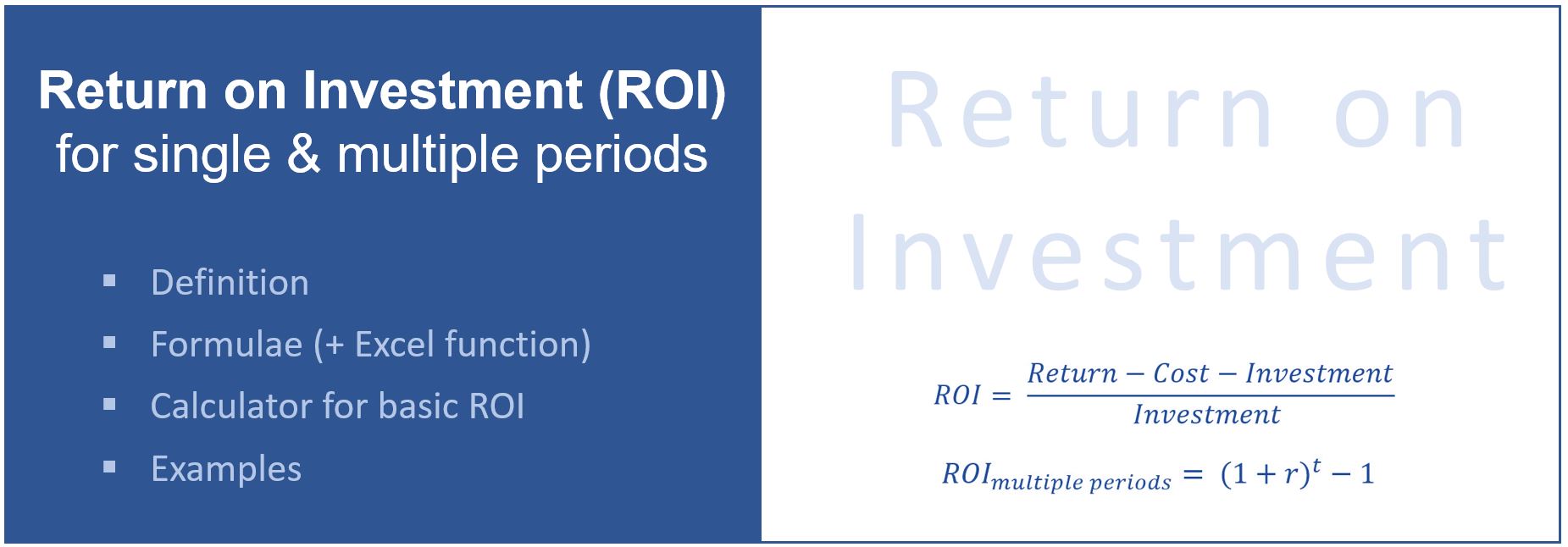

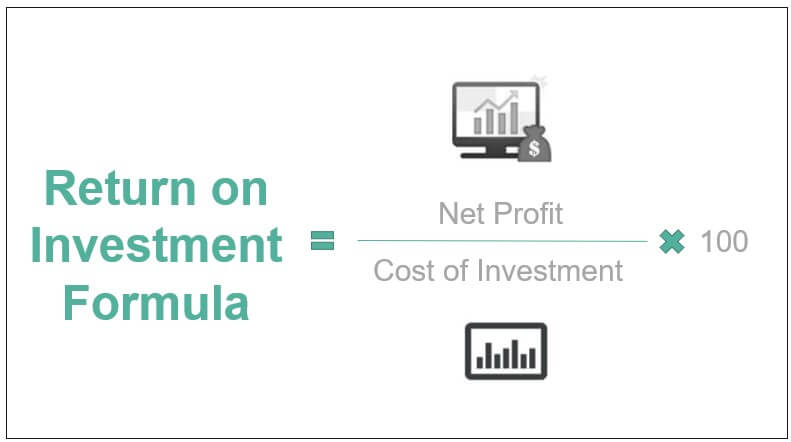

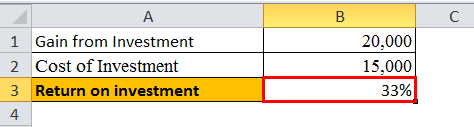

How to Compute Your Income Tax Using the New BIR Tax Rate Table. Return on investment ROI measures how effectively a business uses its capital to generate profit. Internal rate of return IRR is a method of calculating an investments rate of returnThe term internal refers to the fact that the calculation excludes external factors such as the risk-free rate inflation the cost of capital or financial risk.

There is a good chance that Investment B will earn a return quite different from the expected return of 68 possibly as high as 15 or as low as a loss of 5. Go back to the main article. How to Compute Interest Income.

Bobs ROI on his sheep farming operation is 40. Real estate 10 stocks 8 and bonds 2. In statistics and probability analysis the EV is calculated by multiplying each of the possible outcomes by.

A risk premium is the return in excess of the risk-free rate of return an investment is expected to yield. The bank determines that during the 2015 tax year the business had an average number of 30 employees and that for the same tax year the businesss gross receipts were 3000000 and its assets consisted entirely of inventory and working capital. If you choose to compute a CAGR youll also need to enter how long you held the stock into the tool.

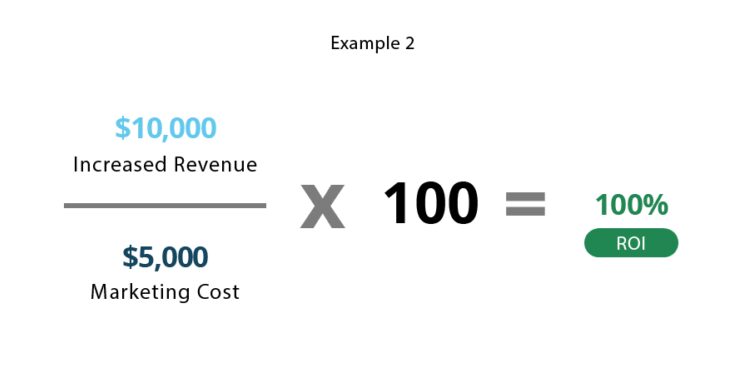

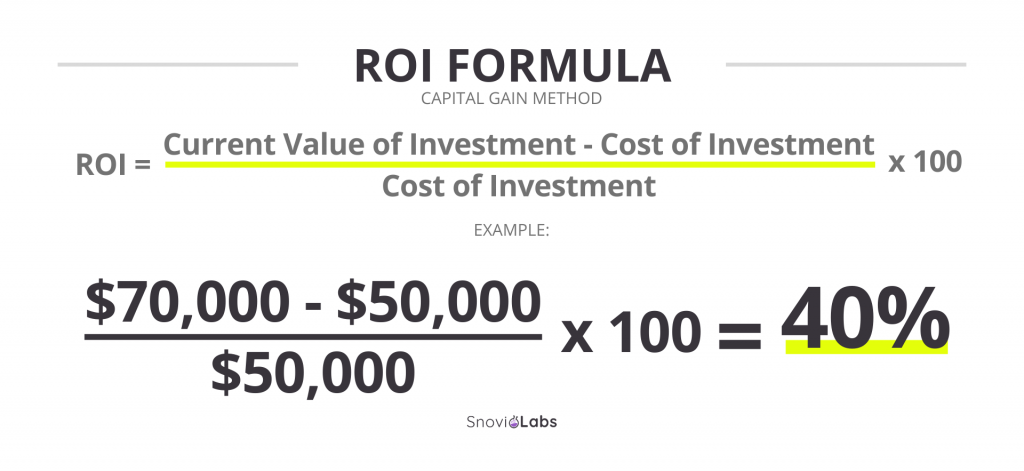

Our estimate of the annualized percentage return by the investment including any periodic investments. Conversely the formula can be used to compute either gain from or cost of investment given a desired ROI. And return on investment.

Optional Set an Investment Holding Timeframe. For any investment property and provide instant feedback on the projected after-tax cost and rate of return. Net Return on Investment.

ROI calculator is a kind of investment calculator that enables you to estimate the profit or loss on your investment. ROI is arguably the most popular metric to use when comparing the attractiveness of one IT investment to another. Simple interest can be computed in very simple steps.

Spreadsheet is the most efficient way to compute present value factors and net present values. It can be handy to visualize compound interest by creating a simple model in Excel that shows the growth of your investment. See our compound annual growth calculator Graph.

The Cisco UCS X210c Compute Node has a three-year Next-Business-Day NBD hardware warranty and a 90-day software warranty. Like net present value method internal rate of return IRR method also takes into account the time value of money. Investment Centre managers can influence manipulate ROI by changing accounting policies determination of investment size or asset treatment of certain items as revenue or capital.

An assets risk premium is a form of compensation for investors who. The expected value EV is an anticipated value for a given investment. See How Finance Works for the present value formula.

Thus you will find the ROI formula helpful when you are going to make a financial decision. Sometimes managers may reduce the investment base by scrapping old machines that still earn a positive return but less than others. The higher the ROI the better.

It comprises any change in value of the investment andor cash flows or securities or other investments which the investor receives from that investment such as interest payments coupons cash dividends stock dividends or the payoff from a derivative or structured productIt may be measured either in absolute terms eg. The IRR calculation for this scenario is rate of return of -1022 which reflects the unfortunate fact that while the gain was 100 in January and the loss was just 30 in February the loss receives a much higher weighting because the investor added dollars to the portfolio just before the loss and had far. Now that we have the return and weight of each investment we need to multiply these numbers.

For real estate we. Tables of present value factors are at the end of this appendix in Exhibit A8. Enter the years 0-5 in cells A2.

Investment A is not likely to. Take the annual interest rate and convert the percentage figure to a decimal figure by simply dividing it by 100. It is essentially a compound interest formula with one of the variables being the number of times the interest is compounded in a year.

The value of the ETF investment over time. Our return on investment calculator can also be used to compare the efficiency of a few investments. Present value is compound interest in reverse.

Start by opening a document and labeling the top cell in columns A B and C Year Value and Interest Earned respectively. If youre on desktop hover over a. Create an Excel document to compute compound interest.

This service centralizes support across your multivendor Cisco environment for both our products and solution partner products that you have deployed in your ecosystem. If you choose to compute CAGR also see the additional fields in the next section. If Bob wanted an ROI of 40 and knew his initial cost of investment was 50000 70000 is the gain he must make from the initial investment to realize his desired ROI.

The internal rate of return sometime known as yield on project is the rate at which an investment project promises to.

Roi Calculator Formula The Online Advertising Guide Ad Calculators

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

Return On Investment Single Multi Period Roi Formulae Examples Calculator Project Management Info

Return On Investment Analysis For An Investor Plan Projections

Return On Investment Roi Definition Equation How To Calculate It

.jpg)

Return On Investment Roi Formula Meaning Investinganswers

Return On Investment Definition Formula Roi Calculation

Return On Investment Roi Formula And Excel Calculator

Calculating Return On Investment Roi In Excel

Return On Investment Roi Definition Equation How To Calculate It

Return On Investment Roi Formula Meaning Investinganswers

What Is Roi Definition Formulas And Tips Snov Io

Return On Investment Ratio Guide To Return On Investment Ratio

What Is Roi Definition Formulas And Tips Snov Io

How To Calculate Return On Investment Roi Free Premium Templates

Return On Investment Definition Formula Roi Calculation

5 Easy Ways To Measure The Roi Of Training